Emotional spending: what is it, its effects and how to manage it

Treating yourself to a new purchase after a period of hard work or difficulty is a luxurious way to practice self-care. If you find you’re reaching for the credit card every time you encounter difficult feelings, then this can be emotional spending.

It can become compulsive, addictive and cause massive problems within relationships and your lifestyle. Here’s how to spot the signs, how they affect you and what to do.

Signs you’re an emotional spender

- Financial stress – even in the face of dire financial debt, you find it hard to regulate or stop yourself from shopping for things you don’t need

- Numbing feelings – you go shopping to manage negative feelings like sadness, anger, boredom or loneliness

- Meticulous planning – you spend an excessive amount of time thinking and detailing your next shopping spree

- Secrecy – You go to excessive lengths to cover your spending habits and hide your purchases from your family and friends

- Theft – You think about alternative sources of income to supplement your spending, including stealing from family or friends or selling sentimental valuables and lying about them.

The effects of emotional spending

- Self-destructive cycle – you feel guilt, self-hatred, and shame over your spending habits. You also feel fear and helplessness because you can’t stop. So you go shopping to feel that amazing adrenaline rush, which covers up the other feelings. Eventually, though they always resurface.

- Relationship breakdown – you’ve lost the trust of your partner and family due to the constant spending and lying, which inevitably leads to arguments. Relationships are built on respect, trust, and love and if you lack one or more of these elements, the relationship is potentially headed for a breakdown.

- Debt – you have fallen behind on your bills and they’re piling up quickly. You find yourself struggling financially, with no savings and managing to pay only the minimum balance on credit cards.

- Quality of life – you have put your family and yourself in a position where you can’t enjoy life: whether it’s going out to the movies, driving somewhere for a day out or going on holiday. Outside of bills, the mortgage, and the basic grocery shop, there is no available money.

- Legal issues – in some cases emotional spenders can get so addicted to shopping, that they put themselves in situations where they are on the wrong side of the law, so they have the money to enable their addictive behaviors.

What to do if you’re an emotional spender

- Acknowledgment – As with any addictive behaviors, the first step is admitting that your behavior is destructive and causing problems in your and your family’s life.

- Triggers – A big part of any addictive behavior therapy is identifying your triggers- these could be a relationship, work stress or self-esteem issues. If you uncover your triggers, you can set up strategies to avoid or cope with them. Seek help from a trained mental health professional to assist you with this.

- Mindfulness – Being present and mindful is an effective technique to help overcome addictive urges. When you feel the need to start spending make every effort to stop and ask yourself aloud:

- How am I feeling at this moment?

- What will happen if I wait?

- How will I pay for it?

- Where will I put it?

- How will my loved one feel about my purchase?

Being self-reflective will encourage awareness about your spending behavior and triggers.

- Set limits – whether it’s by leaving the credit card at home and taking a limited amount of cash or taking someone who can drag you away, kicking and screaming if necessary, from the store, you can get on track to make healthier financial decisions.

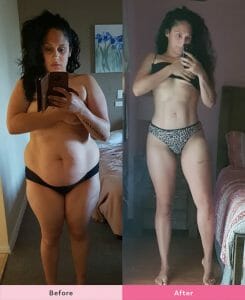

Are you ready to become a Healthy Mommy?

Our Challenge is designed by moms FOR MOMS – to help them reach their goal weight and tackle their health and fitness.

The Challenge is home to customizable meal plans, 24/7 social support and realistic exercises moms can do AT HOME.

To find out more on the 28 Day Weight Loss Challenge click here.